Retail has been rescued. And the credit goes to an unlikely champion: direct-to-consumer brands.

Otherwise known as digital natives, direct-to-consumer brands (DTCs) have experienced a rapid rise. By Inc.’s count, there are now more than 400 DTCs vying for (and winning) our attention and hard-earned income. Many of them, including the likes of Warby Parker, Dollar Shave Club and AllBirds, didn’t even exist a decade ago.

Like their ecommerce predecessors, DTCs find fertile ground on social media and the web. They capitalize on shopping habits established by Amazon and eBay. They are fueled by data and personalization. And they eliminate middleman. By definition, DTCs market and sell directly to consumers, cutting out the need for wholesalers and traditional retailers.

Born and bred online, these challenger brands are growing up and discovering the same truth we all do as we mature: Sometimes those who came before us had the right idea. As they shift from startup to established, DTC’s are harnessing the power of experiential for continued success.

What They Have in Common

Sneakers, sheets, engagement rings. Mattresses, makeup, luggage. Few categories lack a direct-to-consumer disrupter. Though product types, sizes and prices vary from brand to brand, DTCs have more similarities than differences.

They make the most of customer data. Digital natives erupted during the era of big data. In 2014, when many well known DTCs were founded, brands (and everyone else for that matter) had unprecedented access to consumer information. Social media remained a trusted medium. Opt outs were treated as a matter of preference, not of legality. And while cookies tracked our every move, we didn’t know it yet. With our demographics, likes and dislikes at their fingertips, a new generation of brands prepared for takeoff.

They prioritize customer experience. DTCs know what we want because they know who we are. In fact, they have endeared themselves to consumers using the very same data we’ve made public. Through personalization, targeting and automation, DTCs serve up content that meets us where we are and strategically guides the customer journey toward purchasing.

And that’s just the marketing! In the ethos of every successful direct-to-consumer brand is the practice of putting the customer first. DTCs create superior end-to-end purchase experiences, complete with trial opportunities, transparent pricing, quality products and easy returns.

Take Casper for example. The better sleep brand offers a 100-night test run on all of its products. Say their mattress doesn’t suit? They’ll pick it up and refund you in full. A quick look at their website makes it clear: They keep costs down by skipping “ginormous showrooms, commissioned salespeople, [and] overstocked inventories.”

They keep it simple. How many of you have shopped for a mattress? Flopped from bed to bed in a massive room filled with pillow tops and other people? When building their business, Casper questioned this buying behavior. Was this confusing and dehumanizing experience really necessary? The answer was a hard no.

Instead of offering a range of soft to firm or by sleeping position, Casper created one mattress that would work for almost everyone. One mattress (okay, two) to choose from coupled with easy ordering, delivery and returns.

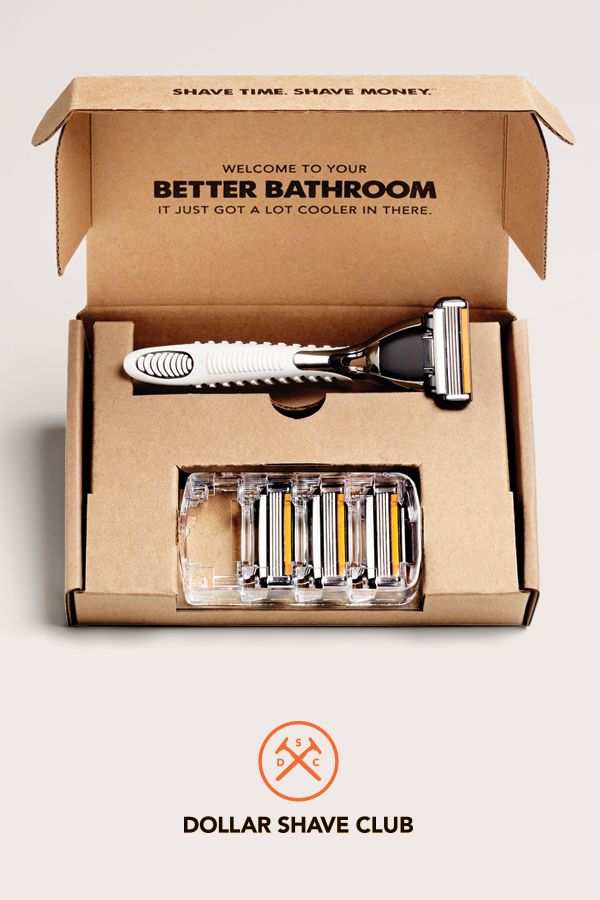

But the pursuit of simplicity doesn’t stop there. Successful direct-to-consumer brands share an affinity for minimalism. Branding is scaled back. Sources are likely to be ethical and sustainable. Packaging is slick and reuse encouraged. The products look like they are made to be Instagrammed. And they are.

They feature real people. Together, Millennials and GenZ possess hundreds of billions of dollars of buying power. But both generations dislike and distrust traditional advertising. To win them over, DTC brands have tapped the source. Rather than featuring supermodels or fake-smiling stock photo families, digital natives gather photographic evidence of customer satisfaction. They employ user-generated content, from rave reviews to enticing images, to market themselves as customer-focused, authentic, inclusive, and trustworthy.

And it doesn’t stop there. Digital natives and influencers grew up together. From their early days, DTCs have put their products in the hands of the internet elite. They understand the power of an Insta pic or an unboxing video to garner impressions and skyrocket sales. Regardless of how “real” influencers may be, employing them illustrates a shift toward prioritizing fresh, diverse faces that reflect consumers’ changing demographics.

Why They’re Turning to Experiential

Direct-to-consumer brands have hit the bigtime. They’ve amassed millions of customers, secured multiple rounds of venture capital, and built a large enough market share by category to light a fire under legacy brands. They’ve also discovered a missing piece in their marketing strategy: experiential.

The rising cost of digital. In the early days of DTC—remember when Warby Parker still mailed eyeglass frames to try on?—the digital ad landscape was far less saturated. Consequently, it was a lot less expensive. Low-budget brands could create a quick-to-go-viral YouTube video or affordably canvas Instagram. Not so these days. Google and Facebook now dominate ad placement, and together, they’re able to dictate prices based on demand. Spoiler alert: demand is high. During the first six months of 2017, the average cost per 1,000 impressions on Facebook increased 171 percent, and the average cost per click increased 136 percent.

Given the rising cost of digital, the question becomes: if cost-per-click “is the new rent, then why not pay actual rent?” Alas, DTCs have started opening storefronts, giving potential customers a taste of their product in real life.

It’s what the people want. Two-thirds of all U.S. consumers expect to be able to converse directly with the companies they buy from. Sure, chatbots help, but the customer desire to communicate with brands demands more. Approximately 82 percent of millennials believe it’s important for a brand to have physical store.

A number of DTCs have successfully made the leap to brick-and-mortar. And as with all things, they’ve come on their own terms. At their physical outlets, sales are a byproduct. Interaction, experimentation, play, and sharing take priority.

People of all ages prefer spending money on experiences rather than things. But what happens when a brand delivers both? DTC brands investing in experiential are finding out.

Warby Parker has opened 66 locations nationwide. And according to Inc., “Within a one-mile radius [in Manhattan], you can walk into stores belonging to a dozen DTC brands—Away luggage, Allbirds sneakers, M.Gemi shoes, Untuckit shirts, Everlane fashion, Indochino menswear, Outdoor Voices activewear, Bonobos men’s clothing, and, of course, Warby Parker.”

New experiences draw repeat customers. Direct-to-consumer brands entered the market during retail’s decline. Standard storefronts couldn’t compete. Digital-first was a safer bet. Indeed, to succeed offline, brands need to offer something more, new, different. And DTCs are bringing it.

AllBirds blur the line between store and showroom in their big city outposts. Customers can browse an artful display of sneakers before taking a seat to try on.

Glossier, a cosmetic brand built by a former blogger, encourages playing with pared back beauty looks. Their stores are a paradise for the under-40 set, complete with dewey makeovers and perfect Instagram lighting.

And then there is Casper. Casper offered a restful outpost at SWSX, hosted a glamping trip during the last total solar eclipse, even set up a nap hotel complete with Casper pillows and sheets. And it appears their experiential efforts are paying off. The brand recently shared plans to open 200 stores throughout North America.

Perhaps nowhere is the lure of DTCs more evident than in New York City’s SoHo neighborhood. Customers funnel in and out of stores. Lines snake down the sidewalk. Tourists pursue the physical outposts as attractions on par with the Statue of Liberty or Carnegie Hall. (Guilty!) And with everyone new product released or in-store experience launched, the need for a repeat visit arises.

Smart companies understand: the customer journey is not linear. It’s an ongoing cycle. And by investing in the potent combination of digital-first, physical-second, customer-always, DTCs will continue to attract—and retain—enthusiastic customers.

How They’ve Spurred a Retail Revolution

Direct-to-consumer brands have unlocked further growth potential by expanding into physical spaces. PwC’s 2019 Global Consumer Insights Study provides proof. In 2018, 24 percent of consumers regularly used mobile to shop, up from 11 percent in 2014. And 49 percent regularly shopped in a physical store, versus 36 percent in 2014.

But the rise of DTCs has affected far more than how we make purchases. These challenger brands have woken the sleeping corporate giants.

Caught flat-footed and concerned for the future, Unilever and Walmart pursued the acquisition route. In 2016, Unilever expanded its stake in the razor business by purchasing Dollar Shave Club for $1 billion in cash. The following year, Walmart bought men’s clothing company Bonobos and the indie and vintage-inspired women’s brand ModCloth for $310 million and more than $50 million, respectively.

A predictable uproar ensued, but sales haven’t ceased. After struggling solo, ModCloth has opened five new stores under Walmart’s ownership. Bonobos’ paychecks now come on Walmart letterhead, but the company’s storefronts and purpose remain. With Unilever’s backing, Dollar Shave Club has scaled and expanded product offerings.

But it isn’t just the big legacy brands that recognizing the need to evolve. The direct-to-consumer approach to brick-and-mortar—with interactive experiences taking front and center—is influencing shopping in its entirety. The Rebecca Minkoff flagship store added interactive mirrors in dressing rooms. Customers can adjust the lighting, order different sizes and colors, and complete self-checkout. Sephora’s Virtual Artist app employs augmented reality to let customers try out products and explore new looks. Both do as DTCs do—merge digital and physical experiences to enhance the customer experience.

Other companies have evolved more slowly—or not at all. Gap, Victoria’s Secret, J.C. Penney, and Abercrombie & Fitch stores make up some of the 4,810 closures already announced by retailers in 2019. Meanwhile, direct-to-consumer brands plan to open 850 brick-and-mortar stores in the next five years.

With direct-to-consumer brands leading the way, all retailers must come to terms with a new reality: success cannot be achieved by solely selling a great product. They must sell a great experience.