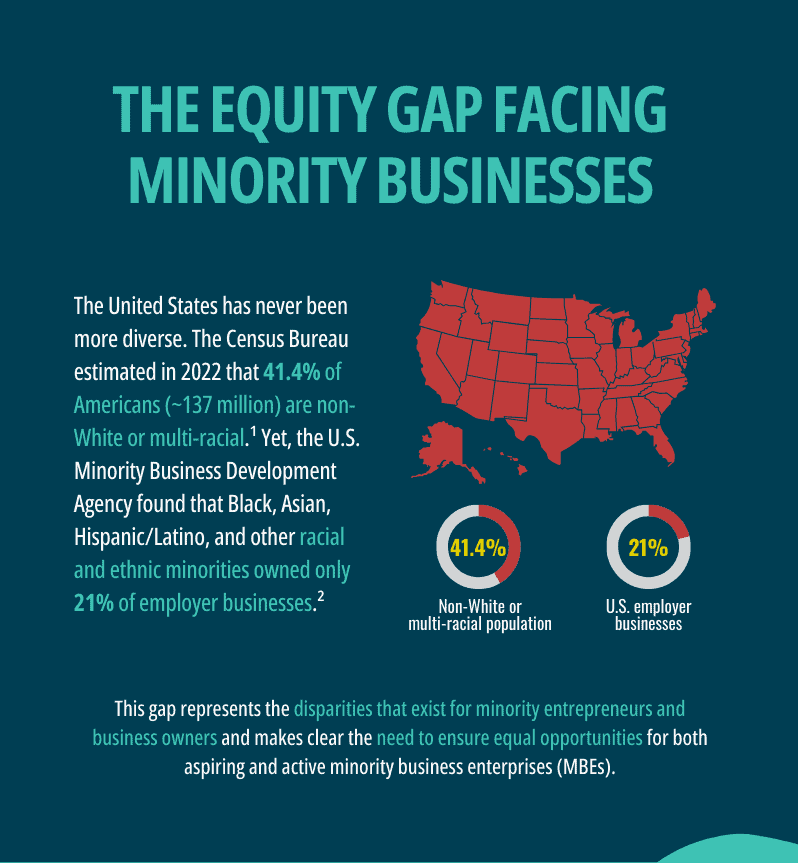

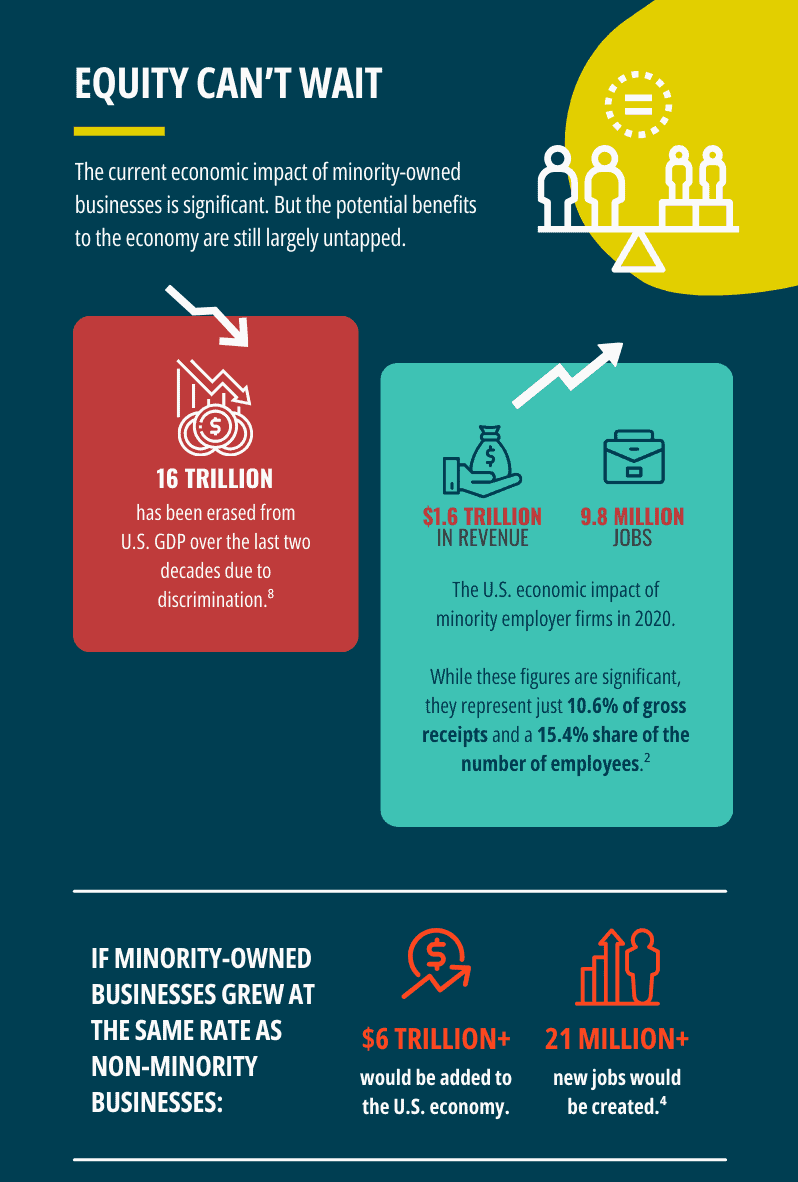

More than $6 trillion and 21 million new jobs would be added to the U.S. economy if minority-owned businesses grew at the same rate as non-minority businesses. That’s one of the reasons we’re at the NMSDC Conference in Baltimore this week.

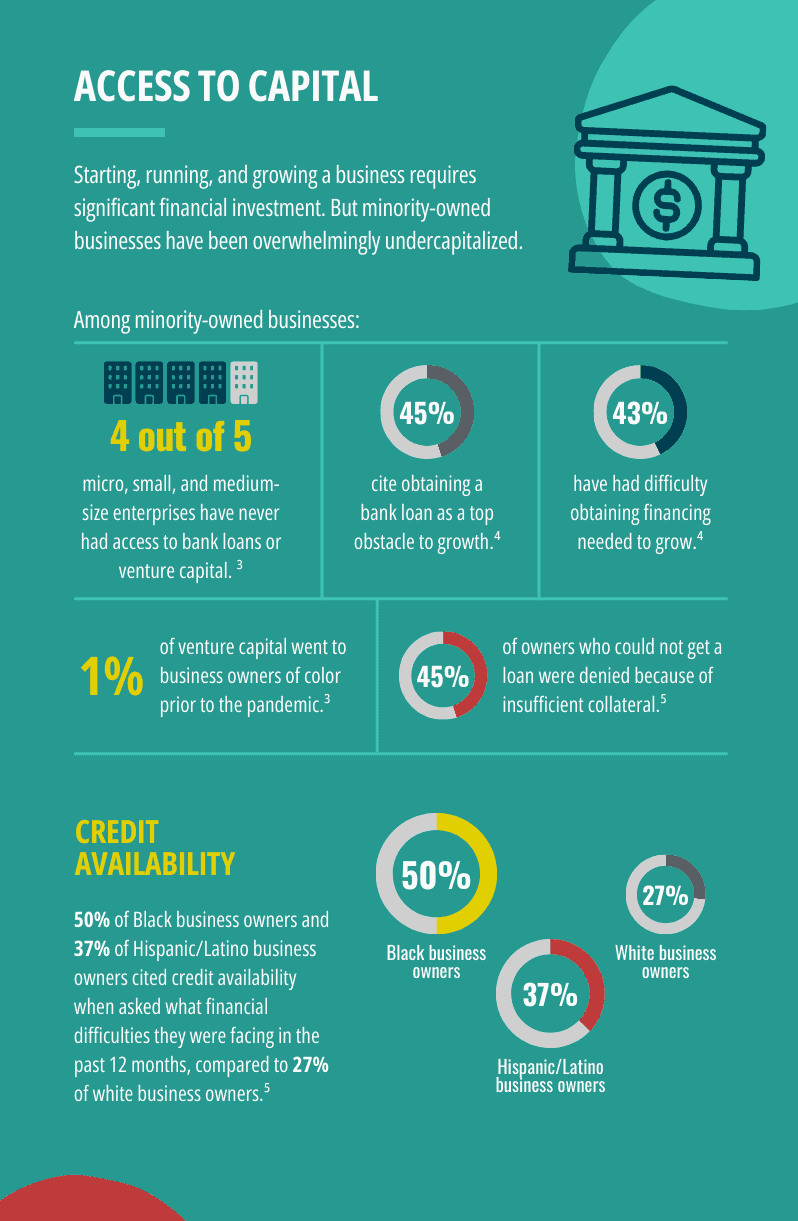

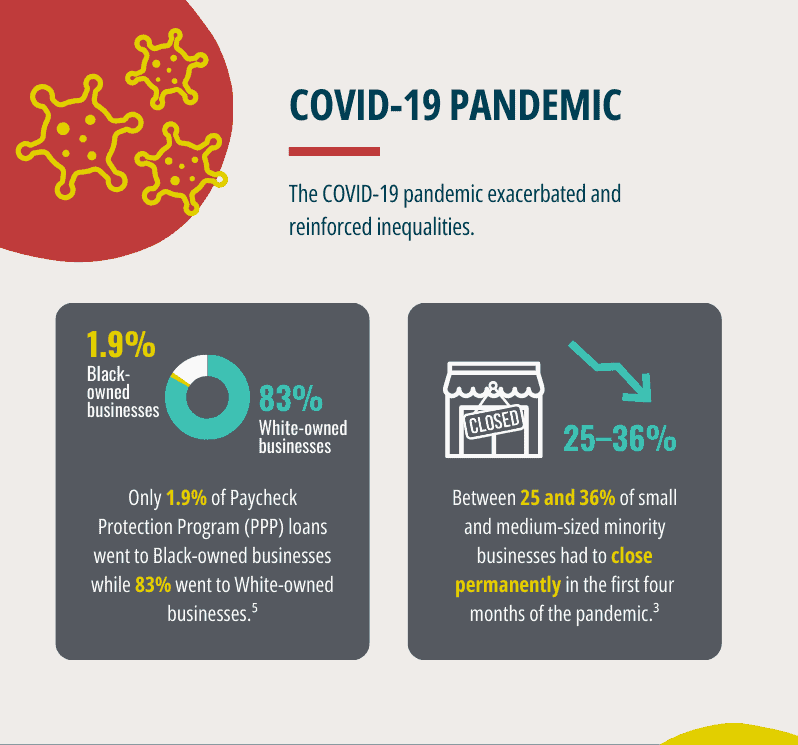

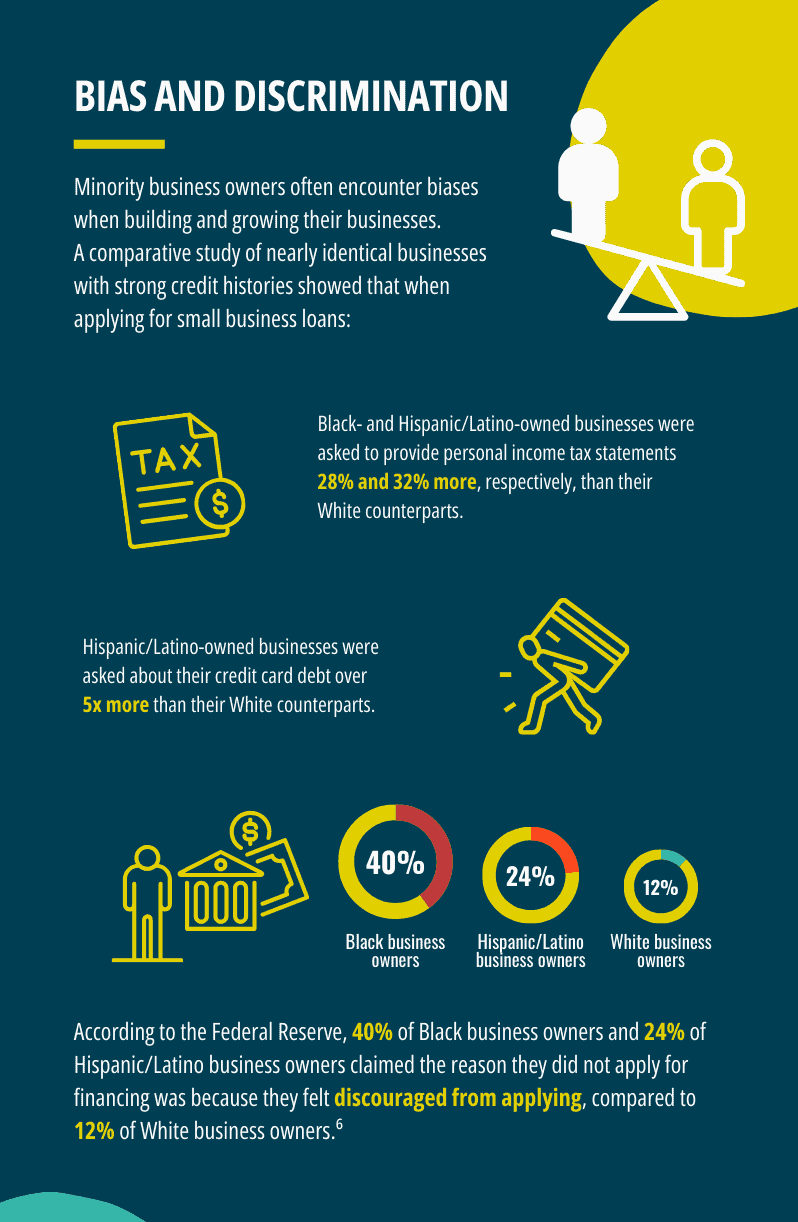

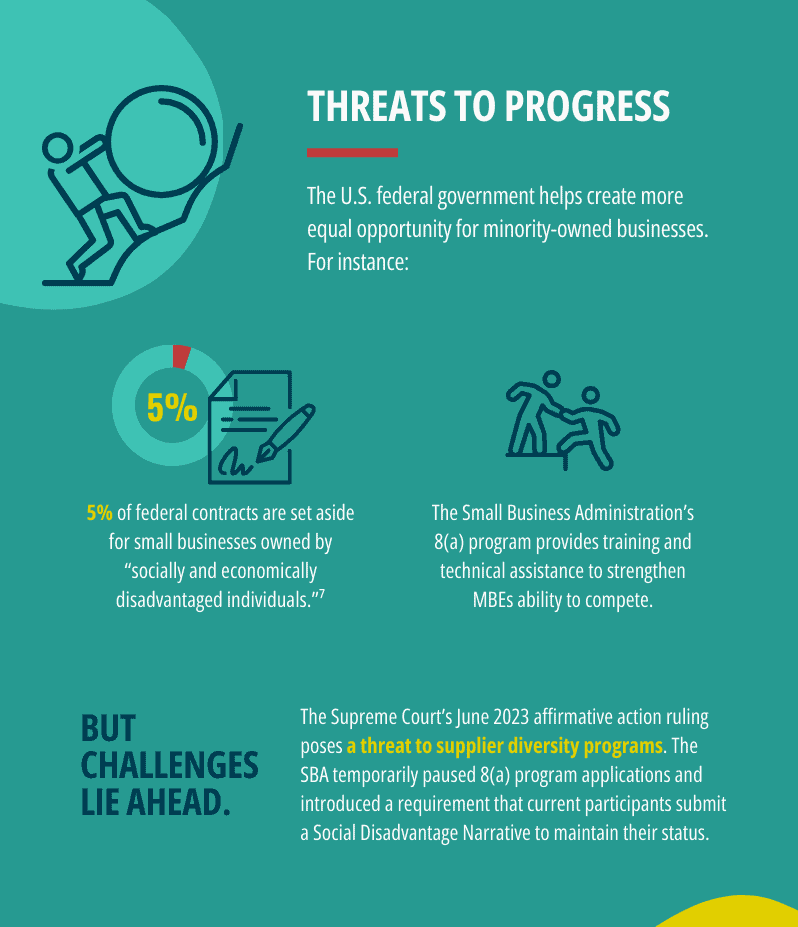

Closing the equity gap starts by understanding the unique challenges minority entrepreneurs face in starting and maintaining businesses. We’ve created this infographic to help make sense of it. What surprises or frustrates you most?

Stay tuned for a follow-up article on our key takeaways from the conference and solutions to close the equity gap.